US hits debt ceiling: whats next

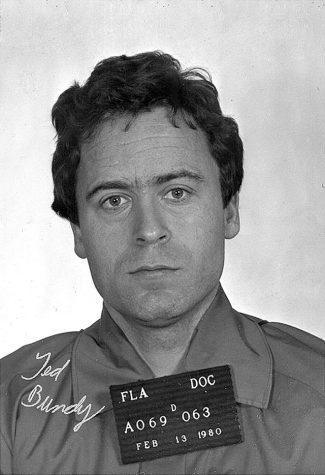

Courtesy of the Federal Reserve

Janet Yellen, Secretary of the Treasury opening up the 2015 FOMC conference

A debt ceiling crisis has once again made its way into Washington. On January 19, the US officially hit the 31.4 trillion dollar debt mark, a limit that was set in December of 2021. Defined by the US Treasury, the debt limit is “the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations.” History Teacher Jenna Scott offered further insight, stating that the debt ceiling is “used as leverage to negotiate other political deals on policy and spending moving forward. It’s a common tactic to help negotiate further discussions in Congress about spending/taxing but draws criticism if the US could potentially default- and becomes a game of economic and political chicken.” The term itself is incredibly familiar to those on Capitol Hill and an issue that’s been debated for years.

In a letter published to the Department of Treasury’s website, Secretary of Treasury Janet Yellen informed Speaker of the House Kevin McCarthy that the government agency will have to begin to take “extraordinary measures” in the wake of this announcement, and urged Congress to “act promptly to protect the full faith and credit of the United States.” Yellen also clarified that the measures will last the government until early June of this year, giving time for lawmakers to reach a definitive decision. As of now, Congress is at a stalemate over whether to raise the debt limit. Per AP News, Republicans are “seeking to secure spending cuts in exchange for a debt limit increase” while Democrats want “the cap raised without any precautions.” President Biden and House Speaker Kevin McCarthy met on February 1 to negotiate potential solutions but were unable to make any progress.

If Congress is successful in raising the limit, Wall Street Journal states that this “would allow the Treasury to raise money for pre-authorized government expenses,” rather than giving the federal government more spending funds. However, if they fail to raise the debt ceiling amount before the Treasury’s “extreme measures” are exhausted, there will be severe consequences for the economy. The Guardian reports that “investors could lose faith in the US Dollar” which would not only result in its value weakening but also cause a plummeting stock rate and high unemployment rates.”

Sophia Lyons is a senior at Clearview and is so excited to start writing for the Pioneer during her final year at Clearview. She loves reading and listening...